Levy Payer

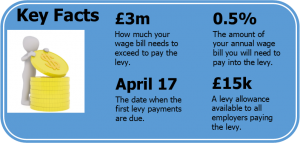

The apprenticeship levy was introduced in May 2017 and if your company has an annual wage bill of over £3 million then you will be classified as a Levy Payer and the funding for apprenticeships will come out of your digital account. You will be required to pay 0.5% of your annual wage bill into your digital account.

The funds in your digital account can only be used for apprenticeship training. You can not use the funds for any other training. As a levy payer, you will be required to pay for the whole course using the funds in your digital account. The course fee will be split into monthly instalments, a payment plan will be set out at the start of the course by the training provider.